Description

Background

The rest of the world: Traders, investors, brokers…are there to take your money. So, be careful.

Trading is not easy. Today´s world is full of smoke sellers that they either Lie or they do not know what they are saying.

Let me tell you something: Just following a line in a chart to decide to open a position is completely nonsense. This is not the way you are going to buy your Ferrari. If it would be so easy the world would be full of Ferraris and , look around, there are more Fiat´s than Ferraries.

Stocks moves are based on fundamentals of the companies, the industry and the sector were the stock belongs. Is also important to understand that a good company does not mean a good stock to trade

Lines on charts might be useful at the end of the process when deciding when to pull the trigger. Not before. Technical analysis provides the right timing. Fundamental analysis provides the right stocks.

Do not follow others when they advise you to buy and sell. Make your own decisions. Start with fundamentals. Fundamentals go first. Be yourself to decide what to buy or sell based on Fundamental data. Know why you are buying or selling. Do not make nonsense copy trading.

To trade successfully, retail traders must adopt a professional mindset. This involves accurately defining market environments, understanding historical trends, maintaining proper trade biases, and systematically analyzing data.

Implementing these practices reduces risk and enhances the consistency of trading performance.

Product Definition

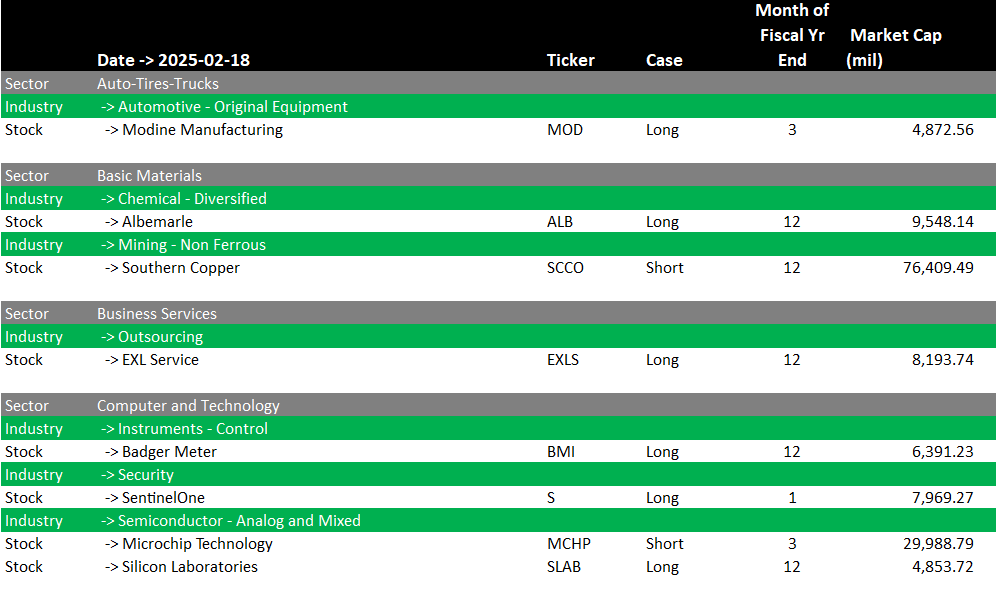

Based on fundamental analysis you will get access on a daily basis to individual stocks that are outlawyers from its industry.

Outlawyers the best and worse performing stocks among his industry in terms of:

1. Price Earning on the current year and next year.

2. Earnings growth projections for current and next year

High PE well understood means quality stocks. That a PE is low does not mean is a good investment might point to low company or industry performance.

Our proprietary system scans on a daily basis more than 2000 stocks of the US Market and finds the best positioned stocks to open long and short positions.

Yes, I know is a boring excel. The charts full of colors are sexier than this. Several screens with lots of charts are even more sexy but, let´s going to be serious: At this stage excel data analysis to start further research is needed.

Based on a subscription fee the users will get the excel file daily the information of the stocks best position to get higher or lower. Based on this you will need to start your own technical analysis and decide if this is, or not a good moment to open the position. If you want to open several positions, you are going to have a Portfolio. Portfolio management in terms of correlation of the positions is also a key step on investing.

The idea is that based on the file users make they own research on the technical situation of the stocks. Good fundamentals do not grant a good trade. Fundamentals are between 70%-80% of the process. 20 % – 30 % of the decision shall be based in fundamentals.

Reviews

There are no reviews yet.